Your Insurance Coverage and Upcoming Deadlines

Article written by SCIC

This article is available in the Summer 2024 issue of Agriview.

Saskatchewan Crop Insurance Corporation (SCIC) offers a full suite of business risk management programs including Crop Insurance, AgriStability, Livestock Price Insurance and the Wildlife Damage Compensation and Prevention Program.

Throughout the growing season, harvest and post-harvest, there are different features of these programs Saskatchewan producers should be aware of – including upcoming deadlines for submitting information and paying programs fees.

If you have questions about your coverage, please contact your local SCIC office or call: 1-888-935-0000.

Statement of Insurance

Crop Insurance customers will soon receive their Statement of Crop Insurance and Invoice in the mail. Your Statement lists your individual premium, insured crops, total number of acres and production guarantee.

As a reminder, the Individual Premium shown on your Statement is inclusive of any premium adjustments, rather than displaying discounts or surcharges separately. Statements show the 60 per cent of premiums paid by the provincial and federal governments and 40 per cent share of premium paid by producers, also listed by crop.

Crop Insurance Coverage, Claims and Deadlines

Crop Insurance customers are covered for both losses in yield and quality. If your insured crop suffers a production loss due to an insurable cause of loss, and you do not plan to harvest the crop, you can file a pre-harvest claim. This requires an adjuster to assess the crop damage; counting viable seeds and plants to assess the yield potential of the damaged acres. If you choose to take an affected crop to harvest, submit your Production Declaration and file a post- harvest claim once harvest is complete. Indemnities are paid if the harvested production, adjusted for quality, of the crop does not meet your production guarantee.

Even if you don’t have a production loss, you are required to report your detailed production to SCIC. Reporting this information each year updates your individual yield history, which updates your future coverage. Conversely, not reporting production could reduce your future Crop Insurance coverage.

Once harvest is complete: report your net production, accounting for weight and dockage, by individual field on your Production Declaration.

Experiencing harvest delays? If you are experiencing delays and will not finish harvest by November 15, you may be eligible for an extension of insurance. Contact SCIC to request an extension before November 15, 2024.

Submit AgriStability Forms by September 30

Once you have year-end financial information for your farm, you can complete your AgriStability forms. This information determines whether your farm qualifies for an AgriStability benefit payment.

As a margin-based program, AgriStability uses financial and supplemental information to calculate program benefits. Once you submit your AgriStability forms and SCIC processes your file, you will receive a Calculation of Benefits explaining how SCIC determines your benefit (if any) and showing a summary of your allowable income, expenses and supplemental information.

The deadline to submit your 2023 AgriStability forms, without penalty, is September 30, 2024. Submitting your program forms annually ensures your farm’s reference margin is up to date and helps avoid file processing delays in subsequent years. If you miss the September 30 deadline, you may be subject to a penalty fee of $500/month deducted from your benefit.

Submit your AgriStability forms by fax, mail or email, or drop off at your local SCIC office. You can also use AgConnect to enter your program information online.

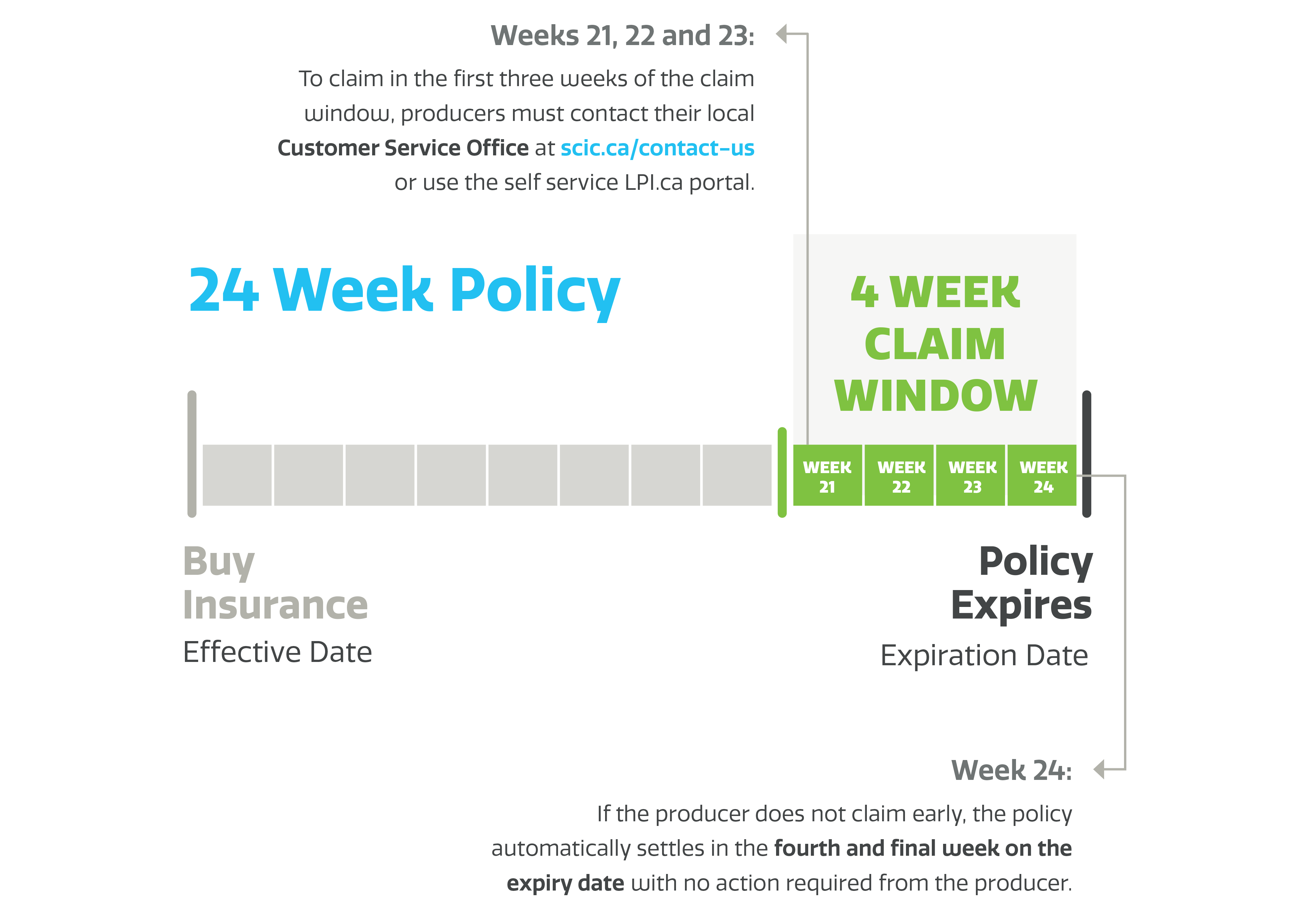

Livestock Price Insurance

Saskatchewan livestock producers can purchase a policy through the Livestock Price Insurance (LPI) Program for forward price coverage against market volatility. LPI offers a range of coverage levels for selection, based off the expected forward price for each policy length (ranging from 12 to 36 weeks from the date of purchase). Coverage is available to purchase on Tuesdays, Wednesdays and Thursdays.

LPI Feeder and Fed programs are available to purchase year-round. The LPI Calf program is seasonal with policies offered from February to mid-June each year. The coverage purchased on those policies, settles for calves intended to market in September through to February.

The claim window occurs in the final four weeks of the policy. A settlement price is published each Monday reflecting the previous week's market. If you are in a claim position you may take action to trigger the claim that day, by settling a portion or all insured weight. Any unclaimed weight may be settled on the following Monday(s), if still in claim position. When the policy is in its expiring week (fourth week of the claim window) and you are in a claim position, the system will automatically settle the policy against that final week's price.

Wildlife Damage: Compensation and Prevention

All Saskatchewan producers may be eligible for compensation on damage to crops and livestock caused by wildlife. You do not need to be an existing SCIC customer to register a wildlife damage claim.

Producers may also receive funding for preventative measures to reduce wildlife damage and proactively protect crops and livestock. Crop damage prevention may include tactics such as fencing, establishing lure crops or using scare cannons. Predation prevention may include deterrents like guardian animals and, when recommended by a SCIC adjuster, a predation specialist can be hired to assess the situation and assist in taking steps to eliminate the predator problem.

SCIC can assist with wildlife damage compensation options and effective wildlife damage prevention strategies. If you discover wildlife damage, contact your SCIC office, call 1-888-935-0000 or register a claim through CropConnect.